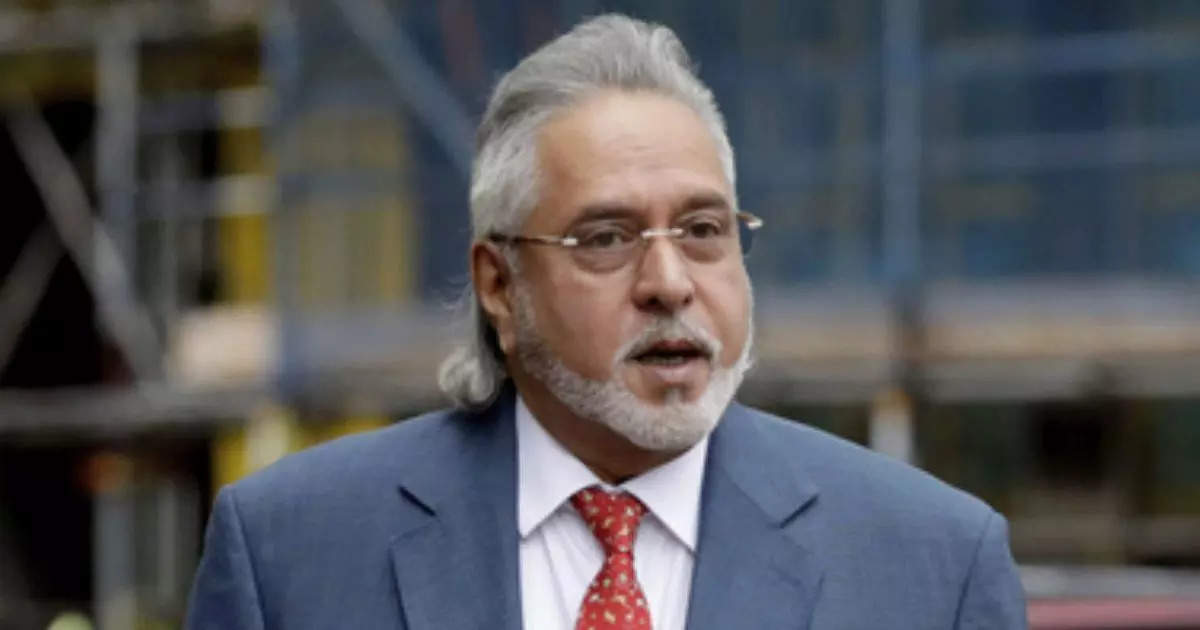

Sebi bans Mallya for 3 years for stock rigging

MUMBAI: Markets regulator Sebi has banned fugitive billionaire Vijay Mallya for three years for illegally routing funds through layered transactions using foreign entities and banks to jack up prices of his own companies and also profit from the same. All his holdings in stocks and mutual funds in India have also been frozen while he has been barred from associating with any listed Indian company as a director.

Sebi investigations found that Mallya had abused the foreign institutional investment (FII) route to trade in the domestic market by concealing his identity in the names of various overseas registered entities, in whose names the bank accounts were opened with UBS.This was done even though Mallya allegedly was the actual beneficial owner of each of the front entities “in a fraudulent manner by employing manipulative and deceptive artifice by indulging in purchase and sale of securities of Herbertsons /United Spirits detrimental to the investors and with an intent to defraud them,” Sebi said. The Sebi investigations found that between January 2006 and December 2008, Mallya had made gains of close to $5.7 million through these fraudulent transactions.

According to Sebi’s FII regulations, only persons and entities who are resident outside India can have an exposure in the Indian securities market through this route. From the scheme devised by Mallya, “it is clearly established that (he had), by way of a design, abused the FII mechanism/route for investing his surplus funds kept abroad and had not revealed the same to the investors of these companies in India,” Sebi report noted.

Sebi investigations found that Mallya had abused the foreign institutional investment (FII) route to trade in the domestic market by concealing his identity in the names of various overseas registered entities, in whose names the bank accounts were opened with UBS.This was done even though Mallya allegedly was the actual beneficial owner of each of the front entities “in a fraudulent manner by employing manipulative and deceptive artifice by indulging in purchase and sale of securities of Herbertsons /United Spirits detrimental to the investors and with an intent to defraud them,” Sebi said. The Sebi investigations found that between January 2006 and December 2008, Mallya had made gains of close to $5.7 million through these fraudulent transactions.

According to Sebi’s FII regulations, only persons and entities who are resident outside India can have an exposure in the Indian securities market through this route. From the scheme devised by Mallya, “it is clearly established that (he had), by way of a design, abused the FII mechanism/route for investing his surplus funds kept abroad and had not revealed the same to the investors of these companies in India,” Sebi report noted.